A crusty veteran’s guide to land syndication – the investment strategy that could save your portfolio and the planet

Look, I’m not a finance guy. I’m a disabled vet who spent decades in special ops logistics and running nightclubs. But after a year of banging my head against the venture capital wall trying to fund regenerative food systems, I’ve discovered something every impact investor needs to know:

You’re using the wrong tool for the job.

Why I’m Writing This

Last year, I dove headfirst into the Denver startup scene with a revolutionary food system model. What I found was a VC ecosystem fundamentally allergic to anything that doesn’t promise a 10x exit in 5 years.

Meanwhile, I’m meeting brilliant regenerative practitioners who can literally reverse climate change by transforming how we grow food, manage water, and build soil. They have proven solutions. They have committed communities. What they don’t have is funding that makes any damn sense for what they’re trying to do.

So here’s my message to anyone with money who actually gives a shit about the future: There’s a better way. It’s called land syndication, and it might just save your ass along with the planet.

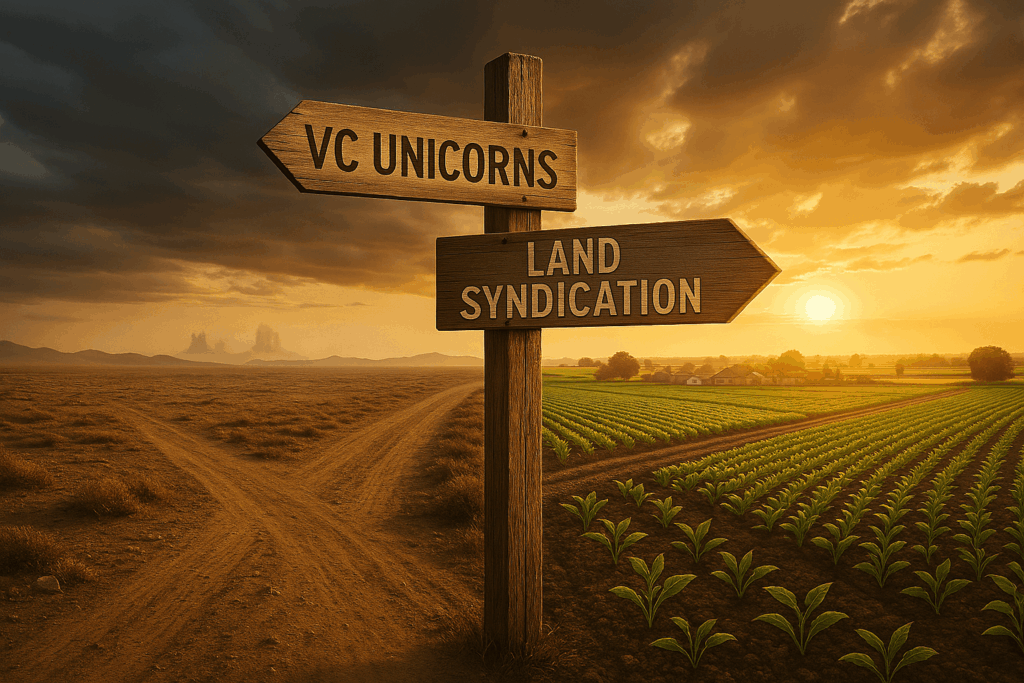

First, Let’s Kill the VC Myth

If you made your money in tech, sports, or business, your advisors are probably pushing you toward VC funds. “Diversify into impact investing,” they say. “Find the next unicorn that also saves the world.”

Here’s what they’re not telling you: VC is structurally designed to destroy the very solutions we need.

- VCs need exits. Regenerative solutions need permanence.

- VCs need hockey stick growth. Nature doesn’t do hockey sticks.

- VCs need control. Communities need sovereignty.

You can’t extract your way to regeneration. Period.

Enter Land Syndication: The Investment Strategy That Actually Works

Land syndication isn’t new. Your grandparents probably invested in them. But here’s why they’re perfect for funding climate solutions:

You’re Investing in Dirt, Not Dreams When you invest in a regenerative farm through syndication, you own a piece of actual land. Not some founder’s promises. Not some company that might pivot to selling NFTs next quarter. Land. Real, physical, can’t-be-disrupted land.

Returns Match Reality Land appreciates as its health improves. Degraded farmland worth $3,000/acre becomes regenerative farmland worth $10,000/acre. Plus you get annual returns from whatever’s being produced – food, carbon credits, renewable energy. It’s not 10x overnight, but it’s real, stable, and actually helps the planet.

You Can See Your Impact Unlike VC where your money disappears into some startup’s burn rate, with land syndication you can literally visit your investment. Watch the soil improve. Meet the farmers. See the community thriving. Try doing that with your crypto portfolio.

No Exit Drama When you want out, you sell your syndication share. The land keeps regenerating. The farmers keep farming. The community keeps thriving. You’re not forcing anyone to sell to Google or go public. You’re just passing your stake to the next investor.

How This Actually Works (Without the Finance Bullshit)

Let’s say there’s a group of farmers in Colorado who want to transition 1,000 acres to regenerative practices. They know how to build soil, sequester carbon, and grow incredible food. But they need infrastructure – processing facilities, storage, distribution.

Traditional lending won’t touch it. VCs want them to “scale” (whatever that means for soil biology).

Here’s the syndication approach:

- Form a syndicate to purchase the land and fund infrastructure

- Farmers operate under long-term regenerative leases

- Investors receive returns from:

- Crop sales (increasing as soil improves)

- Carbon credit sales

- Value-added product sales

- Land appreciation

- Community gets local food security, jobs, and climate resilience

You invest $100K. Over 10 years, you might see 8-12% annual returns plus land appreciation. Not VC returns, but your money is actually fixing things instead of funding some 26-year-old’s “Uber for compost” startup.

Who This Is Really For

Retired Athletes: You made your money with your body. Now invest in healing the planet’s body. Land syndication is tangible, real, and connected to communities – just like sports.

Tech Exits: You disrupted an industry. Great. Now fund the people un-disrupting our climate. And you can visit your investment without needing a slide deck.

Corporate Leaders: You know what real operations look like. Regenerative farms are businesses, not science projects. They need patient capital and strategic thinking, not pivot-happy VCs.

Worried Parents: Your kids are inheriting a climate disaster. You can either fund another meditation app or actually fix the soil they’ll grow food in. Your call.

Anyone Who Eats: This is about securing the food system. If you eat, you have a stake in this working.

What Regenerative Practitioners Need You to Know

I’ve spent the last year learning from people who can read landscapes like I read tactical situations. These aren’t hippies (well, some are). They’re soil scientists, systems thinkers, and practical visionaries who’ve figured out how to:

- Build soil that acts like a carbon sponge

- Create farming systems that use 90% less water

- Produce more food per acre while increasing biodiversity

- Turn degraded land into thriving ecosystems

They’re not asking for charity. They’re offering investment opportunities in the literal ground floor of climate solutions.

The Real Talk Section

Look, I’m not here to blow smoke. Land syndication isn’t perfect:

- Returns are moderate (8-12% typically)

- It’s illiquid (plan on 5-10 year holds)

- You need to be an accredited investor

- There’s real risk (weather, markets, etc.)

But compared to VC? Where 90% of investments go to zero? Where your money funds pivots and burn rates instead of permanent solutions? I’ll take land every time.

Your Next Move

If you’re tired of:

- Advisors pushing you into another VC fund

- “Impact investments” that feel like regular investments with better marketing

- Watching climate change accelerate while your money sits in bonds

- Feeling disconnected from where your wealth goes

Then maybe it’s time to consider land syndication for regenerative projects.

I’m not selling anything. I’m a disabled vet who stumbled into this while trying to fund food system solutions. But I’m connected to brilliant practitioners who need aligned capital, and investors who need better options.

Want to learn more? Let’s talk. Not about slide decks or exit strategies, but about land, soil, communities, and building wealth while healing the planet.

Because at the end of the day, you can’t eat stock options, and your kids can’t breathe ROI.

Time to invest in something real.

Shannon Dobbs is a disabled veteran, systems troubleshooter, and unlikely bridge between regenerative practitioners and the capital they need. After decades in special ops logistics and running businesses, Shannon now connects investors with land syndication opportunities that actually address climate change. Not a financial advisor, just a guy who figured out a better way.

#RegenerativeInvestment #LandSyndication #ClimateInvesting #ImpactInvesting #BeyondVC