Why venture capital misses the trillion-dollar agricultural infrastructure play.

I just saw this post from an investor noting flat agricultural investment numbers and wondering where the opportunities went. Here’s what that analysis is missing: everyone’s hunting for the next platform play while the real money is building agricultural utilities.

The Platform Addiction Problem

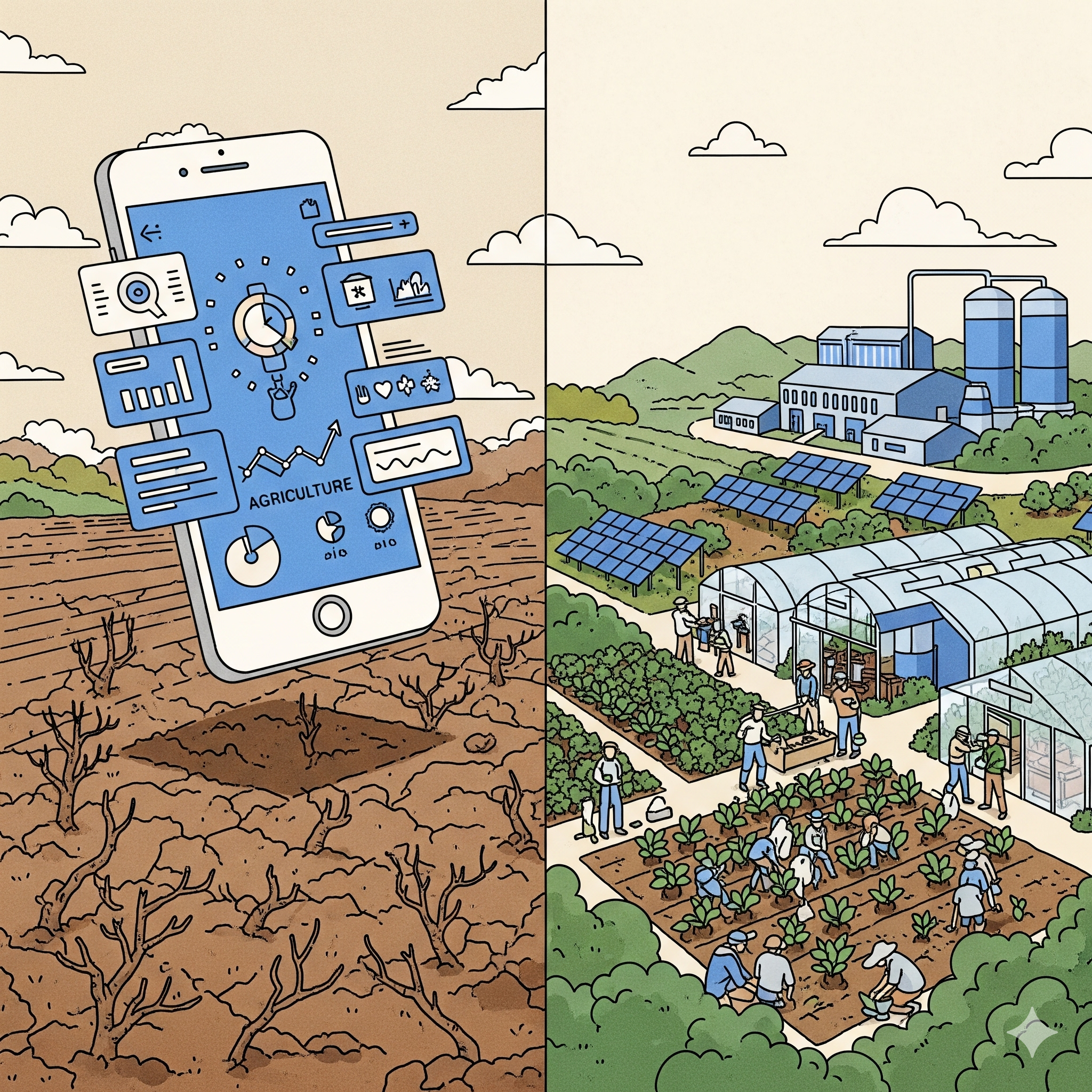

Venture capital has trained an entire generation of investors to look for “Agricultural Uber” – some magical platform that will scale infinitely, create network effects, and generate winner-take-all market dynamics. They want apps that connect farmers to markets, IoT sensors that optimize everything, and blockchain solutions for supply chain transparency.

Meanwhile, the actual agricultural transformation is happening in community-owned infrastructure that generates steady returns through essential services. Think less “disruption,” more “providing electricity to every house in town.

Why Agricultural Platforms Fail

Agriculture isn’t Uber. Food systems are place-based, seasonal, relationship-dependent, and require physical infrastructure that can’t be abstracted into an app. When VCs try to force agricultural businesses into platform models, they break against fundamental realities:

Timeline mismatch: VCs want 3-7 year exits; agricultural infrastructure develops over 10-20 year cyclesGrowth model confusion: Agriculture scales through replication and community ownership, not monopolizationMetric blindness: Platform metrics (user acquisition, engagement, network effects) don’t measure soil health, community resilience, or ecosystem restoration

The result? Billions invested in agricultural startups that solve problems farmers didn’t have while ignoring infrastructure gaps that every community needs.What Agricultural Utilities Look Like

While VCs chase the next FarmTech unicorn, smart money is building agricultural utilities – essential infrastructure that communities own and operate:

Waste-to-Value Processing: Instead of paying disposal costs, municipalities and businesses convert organic waste into soil amendments that sequester carbon and improve agricultural productivity. One utility operator in multiple counties creates revenue streams while solving environmental challenges.

Community Cold Storage Networks: Blast chiller technology that costs under $10,000 can revolutionize food rescue and preservation in any community with a commercial kitchen. Local ownership keeps the economic benefits local while expanding food access.

Regional Coordination Infrastructure: Distribution and processing hubs that connect urban waste streams with rural regenerative projects, creating circular economy loops that benefit every stakeholder.

The Infrastructure Advantage

Agricultural utilities share characteristics that make platform-hunting investors nervous but create exactly what impact investors want:

Steady cash flow from essential services rather than speculative user growthCommunity ownership that builds local wealth instead of extracting itRegulatory support through federal programs that provide matching funds for exactly these approaches

Clear exit strategies through community buyouts that benefit all stakeholdersThe USDA already offers programs supporting community-controlled agricultural infrastructure, with matching funds ranging from 25% to 100% for qualified projects. Veterans get priority positioning. These aren’t experimental programs – they’re established pathways for building exactly the infrastructure that communities need.

The Tax Advantage Hidden in Plain Sight

Here’s what platform-focused investors miss: agricultural infrastructure investments can qualify for significant tax advantages through Section 1244 (ordinary loss treatment up to $100K) and Section 1202 (capital gains exclusion for qualified small business stock). The same tax benefits that VCs chase in tech startups apply to community-owned agricultural infrastructure – but with better risk mitigation through land-based assets and essential service revenue streams.

Stop Chasing Unicorns. Start Building Community Assets.The agricultural investment opportunity isn’t hiding – it’s just not where VCs are looking. While they hunt for the next billion-dollar platform, communities are building the infrastructure that will feed people for generations.

The choice isn’t between technology and agriculture. It’s between extractive platforms that concentrate wealth and community utilities that distribute it. Between speculative network effects and proven essential services. Between exit strategies that leave communities behind and ownership transitions that empower them.

The Real Opportunity

Family offices and impact investors who understand infrastructure can build portfolios of community-owned agricultural utilities that generate steady returns while creating permanent local wealth. Every successful project creates template for replication in other communities, with early investors getting preferred positioning for expansion opportunities.

This isn’t agricultural investment. It’s infrastructure investment that happens to involve agriculture. The difference matters more than most investors realize.The flat agricultural investment numbers your industry tracks? They’re measuring the wrong category entirely.

While venture capital chases platforms that don’t work, the utility builders are quietly transforming how communities create wealth from waste, how regions coordinate resources, and how agricultural infrastructure gets owned and operated.

Stop looking for Agricultural Uber. The future is agricultural utilities, and the communities that build them own that future.

Want to explore agricultural infrastructure investment opportunities? The conversation starts with understanding why community ownership creates better outcomes than platform extraction – and why that difference makes all the financial difference in the world.